Are you health conscious? Do you watch what you eat and work out regularly? If so, your life insurance company could be overcharging you on your insurance premiums. Insurance companies use data gathered from the life insurance medical exam to determine your insurance premiums, but each insurance company has different guidelines for interpreting this data. This means that even the healthiest among us could be mislabeled as “unhealthy” and be forced to pay higher premiums—and that’s not fair.

Below are the 4 most common ways insurance companies are overcharging you, and how Health IQ can help you in those situations.

#1: If You Lift Weights, Insurers May Mislabel You as “Obese”

BMI is not a perfect predictor of cardiovascular health! During the life insurance medical exam, insurers will take your height/weight ratio to find your BMI (Body Mass Index). This index helps the insurers assess the likelihood that you will develop a cardiovascular disease—which could lead to a premature death. Those with higher BMIs are labeled as “overweight” or “obese” and are charged higher premiums. In extreme cases, some applicants are even denied life insurance coverage altogether.

But the BMI test doesn’t distinguish between muscle and fat. So those with more muscle—such as Crossfiters or weightlifters—tend to be mislabeled as “obese” and thus receive higher premiums than they otherwise would receive.

How Can Health IQ Help Me?

Each carrier has different guidelines around what classifies as “overweight” or “obese” when assessing BMI. One carrier might offer you a standard health classification, while another might offer you a health classification that could double your premiums. Experienced agents know which carriers are more lenient when it comes to BMI, so make sure to let your agent know if you think you have more than the average amount of muscle mass for your height and weight.

At Health IQ, our agents also push our carriers to use a “BMI buffer” for our health conscious clients. For example, if the limit a carrier has for preferred plus rate category for someone who is 5’9 is 198 lbs, our team will work with the carriers to get a client who is 208 lbs preferred plus rate category.

#2: If You Do a Low-Carb Diet, Insurers May Think You Have an Unhealthy Level of Cholesterol

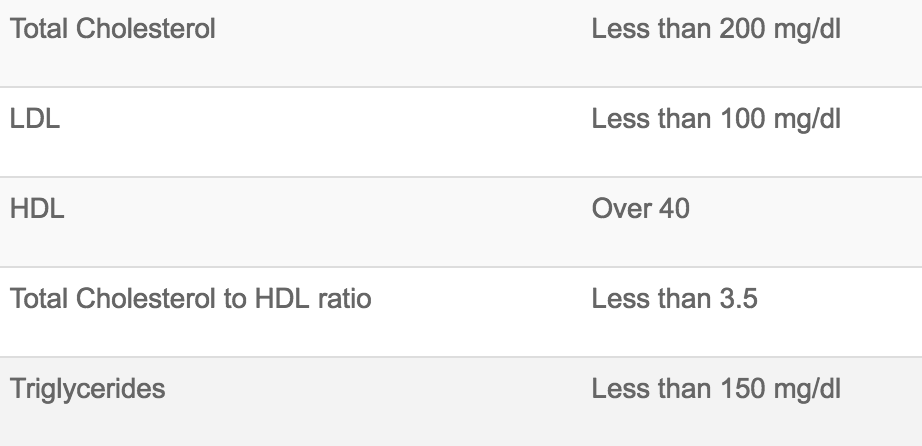

If you’re on a low carb diet, how your insurer measures your cholesterol could affect your rates. In addition to BMI, insurers will also test your total cholesterol levels during the life insurance medical exam to assess your risk of a heart problem. Every insurer has a different guideline for assessing total cholesterol and risk, but below are optimal levels that should not negatively impact your life insurance rates.

However, there are many factors associated with low carb dieting that can push your total cholesterol outside of these ranges. Diets that are low in carbohydrates but high in fat (Paleo, Atkins, etc.) tend to create fluctuating cholesterol levels or higher levels of HDL (also know as good cholesterol).

How Can Health IQ Help Me?

If you are a Health IQ client, know that we work with carriers to modify the underwriting process—getting carriers to accept Triglyceride/HDL Ratio instead of Cholesterol + Cholesterol/HDL Ratio to assess mortality risk. Triglyceride/HDL ratio is a better predictor of cardiovascular disease, and it is possible to have total cholesterol in 220-260 range with little risk of atherosclerosis if it’s HDL high and TG low.

#3: If You’re A Runner, Insurers May Think You Have Heart Problems

Endurance athletes that have low resting heart rates may be mislabeled has having heart problems. During the medical exam, life insurance companies will look at your heart rate as an indicator of overall heart health. Heart rates for an average adult are generally in the range of 60 – 100 beats per minute, but very fit individuals could see heart rates as low as 40 to 60 beats per minute (e.g. Miguel Indurain, who won 5 consecutive Tours de France, has a resting heart rate of 28 beats per minute). So those with low resting heart rates but who are healthy could be mislabeled as having heart problems—and bumped down in their rate class.

How Health IQ Can Help Me?

If you suspect that your heart rate is below average, Health IQ has you covered. We are the only life insurance company that has convinced carriers to recognize that your low resting heart rate is a sign of your excellent health and fitness, so your rates don’t go up.

#4: Your Insurer Doesn’t Have Special Rates for Health Conscious People

Only Health IQ can give you a special rate for being health conscious. On top of special underwriting, you can get an additional 4% – 8% off your insurance premiums by scoring elite on our Health IQ quiz and verifying your level of fitness with Health IQ. To date, over one million people have taken our quiz and received their Health IQ score. And through scientific analysis and this proprietary data, we were able to convince some of the top insurers to give special rates on term life insurance for those who prove to have a high Health IQ. Over 56% of our clients end up qualifying for this special rate.

How Health IQ Can Help Me?

Click Get Your Quote or call 1 (800) 549-1664 to speak to a Health IQ agent who has more info about our special rates. To learn more about our special rates, check out our in-depth FAQ here, or watch the video below. Bottom line is that at Health IQ, we believe you deserve special rates for being health conscious. And we’re here to help you get the rate you deserve, so call us anytime for more information.

https://www.youtube.com/watch?v=hIcPEx9Ibe8

I am continually browsing online for tips that can facilitate me. Thanks!